Money from Family

When it comes to money, it is easy for unforeseen issues to get in the way of our plans, and college planning is no exception. Many unforeseen issues can get in the way of financial planning. That’s why an emergency fund is so important. Make backup plans with your family to cover any unexpected costs.

#1: Talk to your family as early as possible

You might feel tempted to wait because you don’t want to trouble your family with financial concerns. However, the best thing you can do to reduce their stress about your college costs is give them plenty of time to prepare. Delaying this conversation can create a very big stressor because it may be too late to adequately prepare the necessary paperwork or consider other options.

#2: Be the one to initiate the conversation

Some students feel it is not their place to start conversations about finances and may wait for their family to initiate the discussion instead. But you are the one who is ultimately responsible for managing your college expenses. Since your college finances will affect your future, it is your responsibility to seek out help and support. Start by being proactive in seeking out your family’s support and guidance.

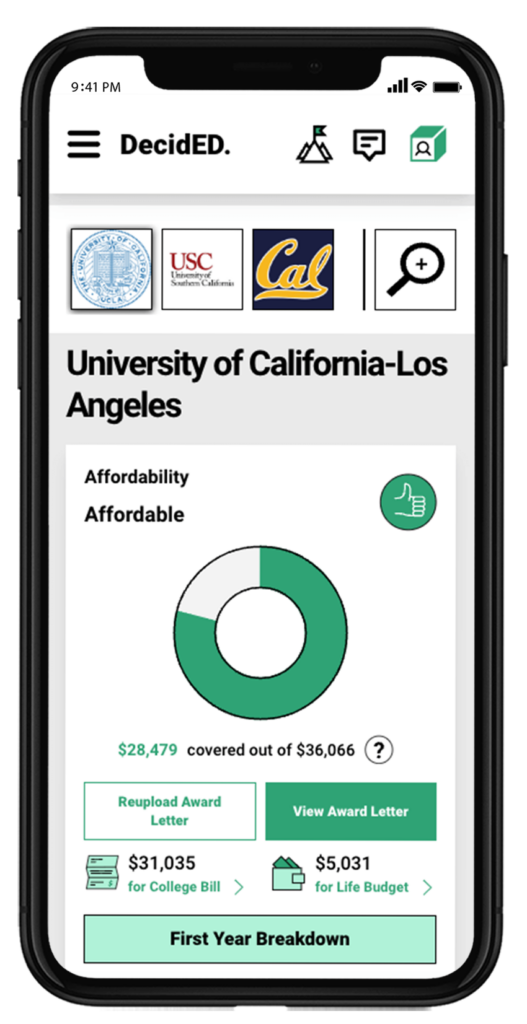

#3: Use DecidED to remove stress

Not knowing your college financial situation is stressful for you and your family. You have the ability to bring peace of mind to your family by presenting them with your options and the cost of each. Your DecidED profile, which will break down all of your options and funding sources, is a great resource in helping you understand your out-of-pocket college costs. After you’ve uploaded your award letters to your profile on DecidED, show your family the out of pocket costs at each of your schools and talk openly about what your options are for covering those gaps.

#4: Be realistic

When it comes to money, it is easy for unforeseen issues to get in the way of our plans, and college planning is no exception. Many unforeseen issues can get in the way of financial planning. That’s why an emergency fund is so important. Make backup plans with your family to cover any unexpected costs.

#5: Let go of guilt

Some students feel guilty because they do not want to ask their families for money. This conversation isn’t necessarily just about asking for money – it’s about working together to understand your financial options.

One way to feel better is by letting your family know that you appreciate their help in decision-making, regardless of how much or whether they can contribute financially. You can reinforce your gratitude by talking to your family regularly about your decision and discussing your options together, along with trusted school counselors and college advisors.

#6: Use these conversation starters

If you are deciding where to go to college: “Hey, I’m using DecidED to help me figure out which college would be the most affordable for me. Can we find a time this week to sit down and look at DecidED together? I want to hear what you think about my options.”

If you have already decided where you are going to college: “DecidED provides information to help me choose an affordable college. The tool shows the financial choices I have to make to pay for college, like how much I’ll have to work or take out in loans to cover my costs beyond any grants or scholarships I receive. I want to get your help making these decisions by looking through all of the information together. When would be a good time this week?”

If you aren’t sure how to ask your family how much money they can contribute: “There are still some college costs that I have to cover myself, even after getting loans and scholarships. Just so that I know what my options are, I want to ask how much you think you can cover next year. No matter what that amount is, it’s just good to know so that we can plan better.”