Get Your Loans on Time

Typically in July or August, you will receive a tuition bill for your first semester of college. To make sure that bill accurately shows how much you owe, be sure to accept loans as soon as possible.

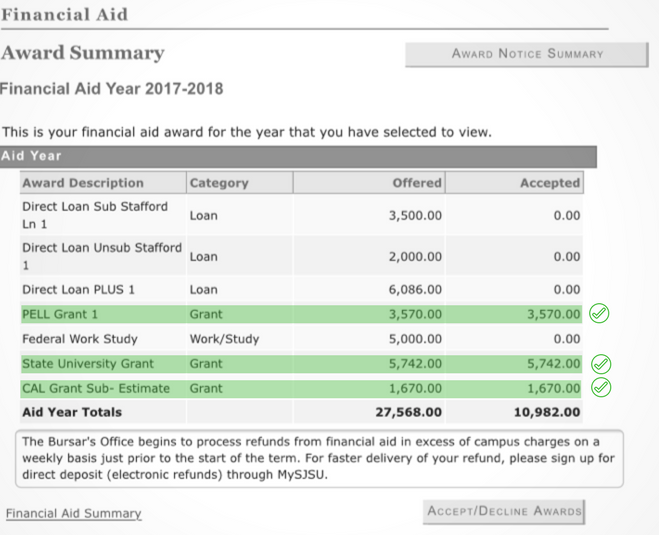

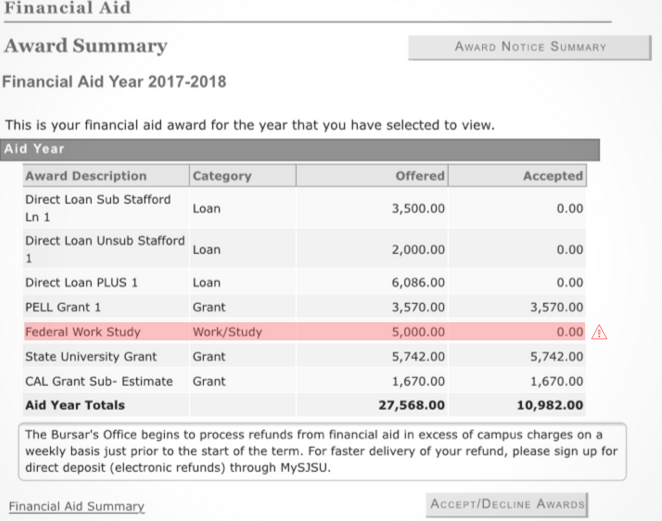

1. Accept your grants and scholarships

Log into your school’s online portal, go to the financial aid section, and accept your grants and scholarships.

2. Accept your work study

Accepting “work study” does not commit you to using work-study or guarantee you a work-study position. To learn more about work-study check out our guide to Learn About On and Off-campus Jobs.

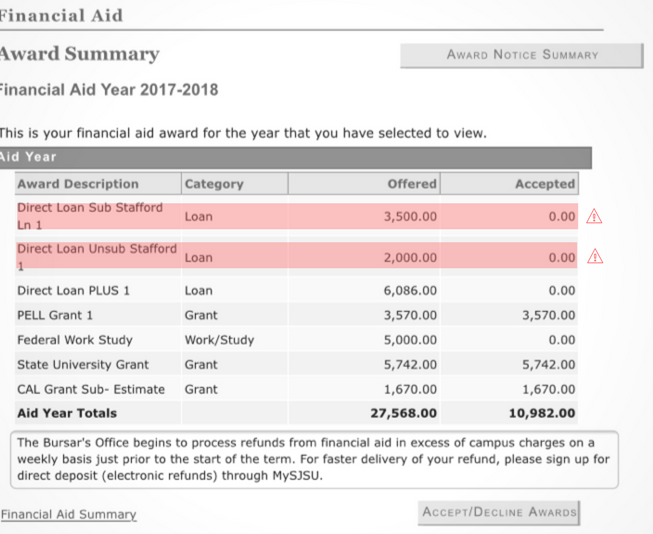

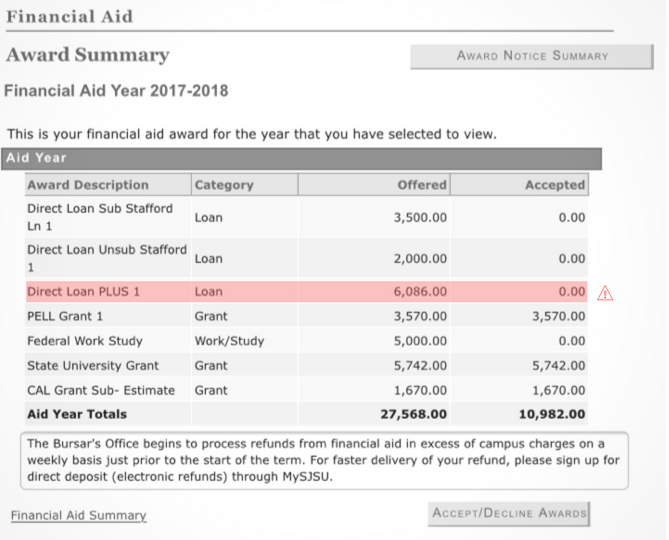

3. Accept your loans

You can increase or decrease the loan amount that you would like to accept. To learn more about loans check out our Ultimate Guide to Loans.

Subsidized or Unsubsidized Loans

Parent PLUS Loans

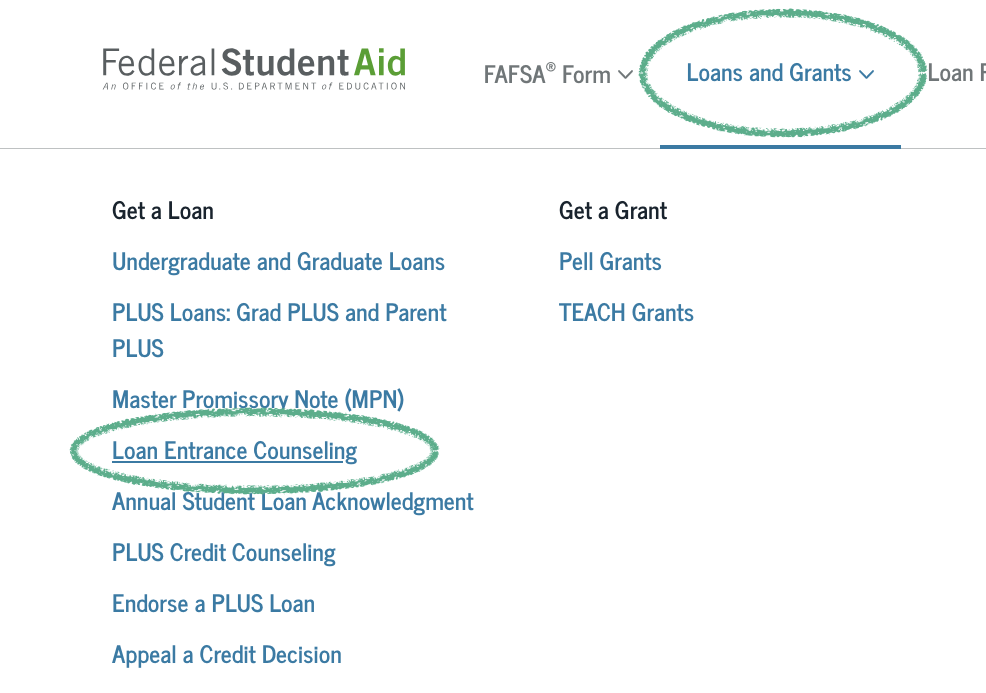

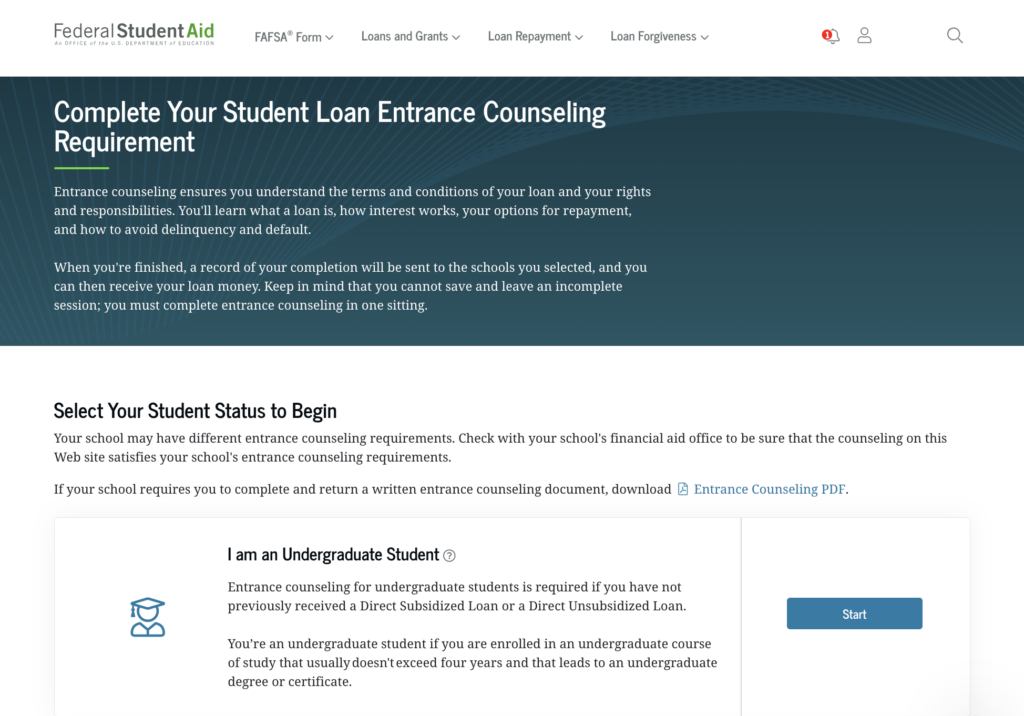

Do online loan counseling

Everyone who takes out federal loans has to complete a learning exercise to make sure they understand repayment responsibilities. Your answers don’t impact how much you actually take out in loans.

For most schools, you can complete loan counseling on the Federal Student Aid Website. To log in to complete loan counseling, you will need your FSA ID. This is the same FSA ID that you created when you submitted your FAFSA online. The loan counseling process takes about 30 minutes.

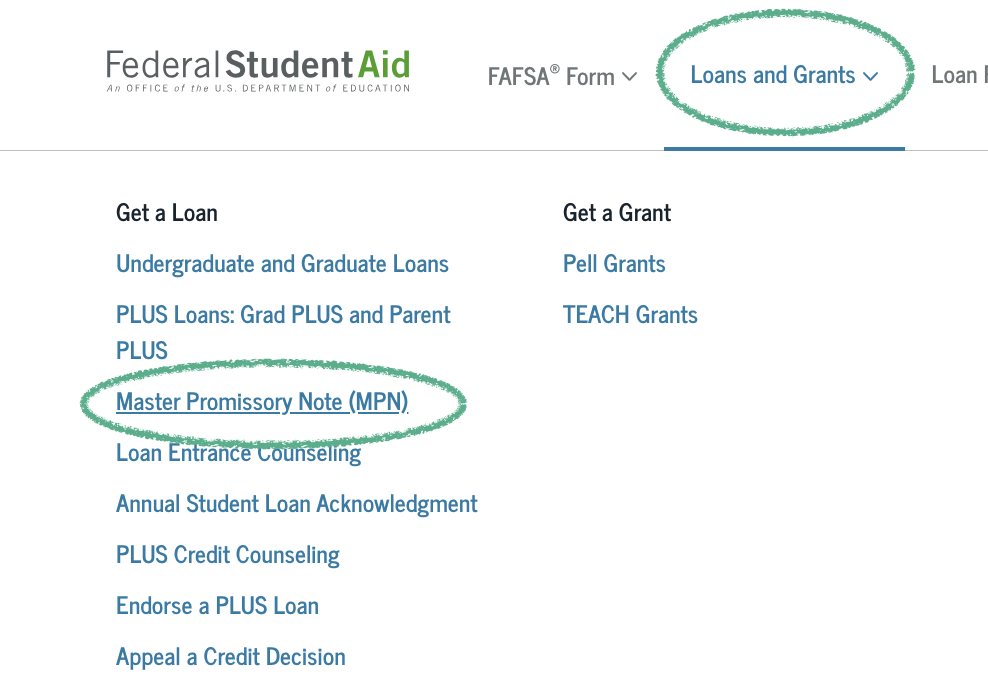

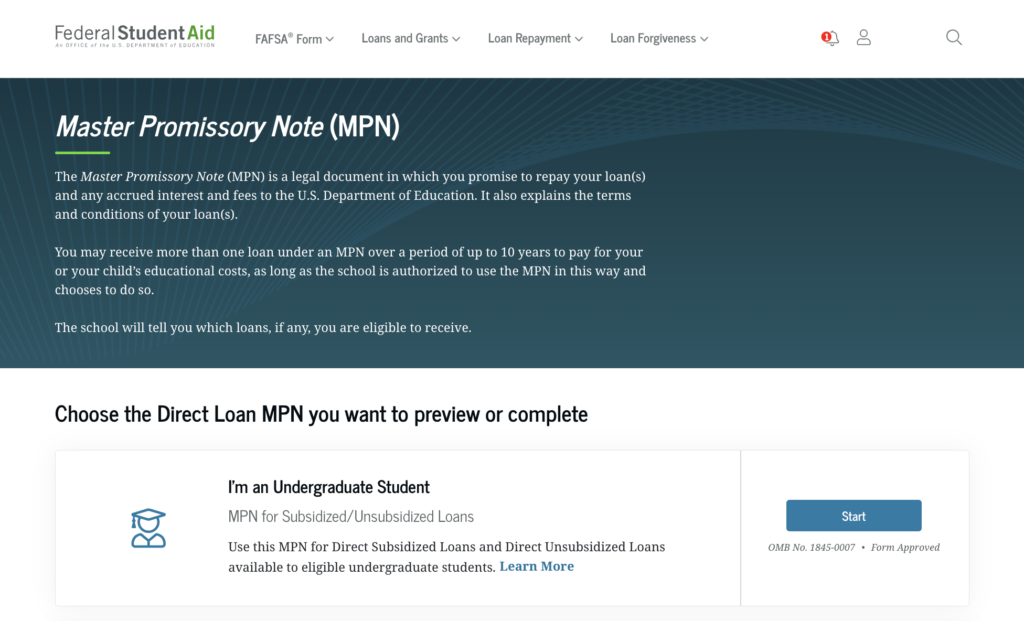

Sign an online master promissory note

Everyone who takes out federal loans is required to sign a Master Promissory Note (MPN). When you sign the MPN, you’re acknowledging that you understand you are responsible for any federal loans you take out in college. You are not agreeing to how much you’re taking out.

For most schools, you can sign the MPN on the Federal Student Aid Website. To log in to complete loan counseling, you will need your FSA ID. This is the same FSA ID that you created when you submitted your FAFSA online. The whole MPN signing process takes about ten minutes.